Excitement About Bank Code

Wiki Article

Facts About Bank Revealed

Table of ContentsRumored Buzz on Bank Account NumberThe Single Strategy To Use For Bank Account NumberGetting My Bank To WorkThe Bank Reconciliation DiariesHow Bank Certificate can Save You Time, Stress, and Money.

When a financial institution is perceivedrightly or wronglyto have problems, customers, fearing that they might shed their down payments, may withdraw their funds so quick that the small portion of fluid possessions a financial institution holds becomes rapidly exhausted. Throughout such a "work on down payments" a bank might have to sell various other longer-term as well as much less liquid possessions, commonly muddle-headed, to meet the withdrawal needs.

Regulatory authorities have broad powers to intervene in troubled financial institutions to lessen interruptions. Rules are usually designed to limit banks' exposures to credit rating, market, as well as liquidity risks and to total solvency danger (see "Safeguarding the Whole" in this issue of F&D). Financial institutions are now needed to hold more and higher-quality equityfor example, in the form of kept earnings as well as paid-in capitalto barrier losses than they were before the monetary crisis.

The 9-Second Trick For Bank

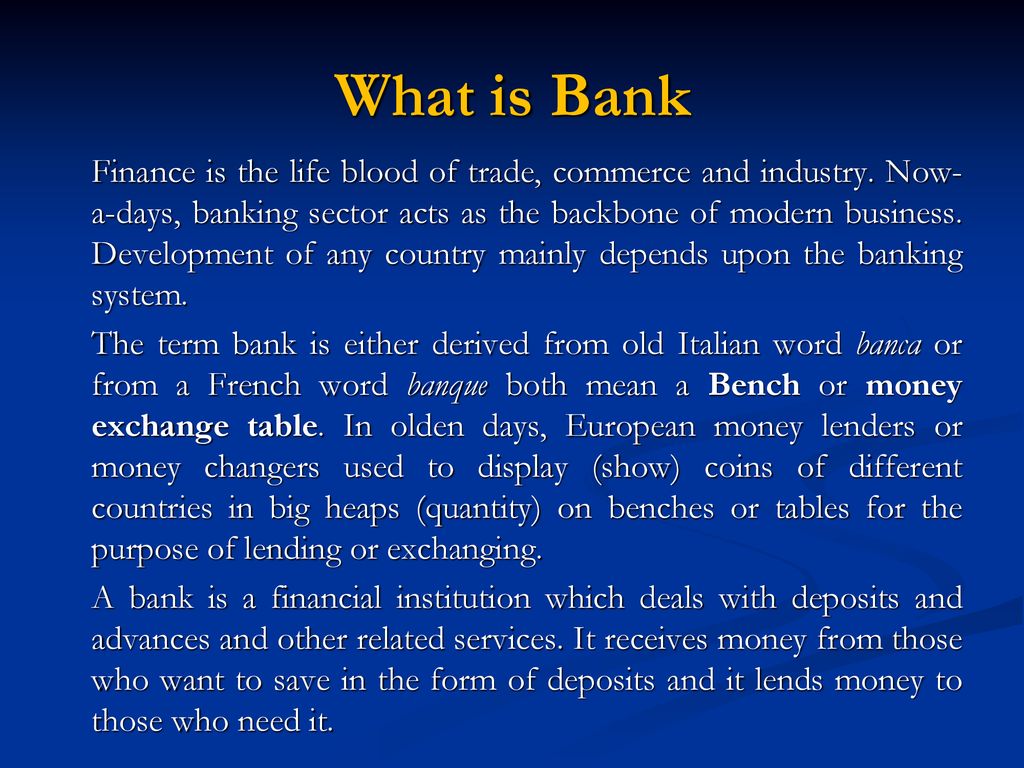

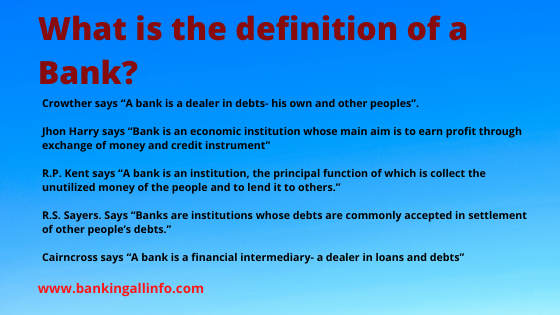

A financial institution is an economic institution licensed to offer solution choices for clients that want to conserve, borrow or accrue more money. Banks usually accept deposits from, and offer financings to, their consumers. Can assist you obtain funds without a financial institution examining account.While banks might supply similar financial services as debt unions, banks are for-profit companies that guide most of their monetary returns to their investors. That means that they are much less likely to provide you the finest feasible terms on a lending or a savings account.

Those borrowers then pay the loan back to the bank, with rate of interest, over a set time (bank certificate). As the debtors repay their fundings, the financial institution pays a portion of the paid rate of interest to its account holders for allowing it to utilize the deposited money for issued lendings. To even more your individual and company interests, financial institutions provide a big selection of economic solutions, each with its very own positives as well as downsides relying on what your cash motivations are and also just how they may develop.

What Does Bank Draft Meaning Do?

Financial institutions are not one-size-fits-all operations. Different kinds of customers will find that some financial institutions are better financial companions for their objectives as well as demands than others.The Federal Reserve regulates other financial institutions based in the U.S., although it is not the only government agency that does so. Community banks have fewer possessions since they are inapplicable to a significant copyright, but they provide economic services throughout a smaller sized geographic impact, like a county or region.

On-line banks do not have physical places yet often tend to provide much better rate of interest on lendings or accounts than financial institutions with physical locations. Transactions with these online-only institutions generally take place over a site or mobile application and also thus are best for somebody that does not require in-person support and fits with doing a lot of their financial electronically.

view publisher site

The 5-Minute Rule for Bank Reconciliation

(C) United State Bancorp (USB) Unless you plan to stash your money under your mattress, you will ultimately require to engage with a financial institution that can secure your money or problem you a loan. While a financial institution might not be the institution you at some point pick for your economic demands, comprehending just how they operate as well as the services they can supply can assist you decide what to look for when making your option.Larger financial institutions will likely have a collection of brick-and-mortar branches and Atm machines in hassle-free locations, in addition to various electronic banking offerings. What's the difference between a bank as well as a credit score union? Because financial institutions are for-profit institutions, they have a tendency to provide much less attractive terms for their customers than a lending institution may offer to maximize returns for their capitalists.

a long raised mass, esp of earth; mound; ridgea slope, as of a hillthe sloping side of any type of hollow in the ground, esp when bordering a riverthe left financial institution of a river gets on a spectator's left looking downstream a raised area, rising to near the surface, of the bed of a sea, lake, or river (in mix) sandbank; mudbank the location around the mouth of the shaft of a mine the face of a body of orethe side inclination of an airplane about its longitudinal axis during a turn, Also called: financial, camber, cant, superelevation a bend on a road or on a train, athletics, biking, or other track having the outdoors built higher than the within in order to minimize the results of centrifugal force on lorries, runners, and so on, rounding it at speed and in some instances to promote drainagethe padding of a billiard table. bank reconciliation.

The Best Guide To Bank

You'll require to give a financial institution declaration when you apply for a finance, documents tax obligations, or apply for divorce. Loading Something is packing. A bank statement is a document that summarizes your account activity over a specific period of time. A "statement period" is generally one month, yet maybe one quarter sometimes.

Report this wiki page